How Visa is trying to simplify (and reduce) credit card disputes

Shane Schick tells stories that help people innovate, and to…

Haven’t we all felt like Liz Chaffin at some point – where a package arrives at our doorstep that you didn’t expect and you have to ask yourself, “Am I losing it?

For the vice-president of product management at Visa, the package in question contained a vegetable chopper. It turned out it had been sent by a friend who was travelling and needed her to hold onto it until they returned. Had that mystery remained unsolved, though, Chaffin would likely have had to undergo one of the least popular customer experiences of all – disputing a charge on her credit card bill.

“The process become so seamless it can be invisible to customers, which can lead to confusion,” Chaffin said during a session at ServiceNow’s recent Knowledge 2024 customer event.

By “the process,” of course, Chaffin is referring to buying products, which traditionally had informed swiping or tapping a Visa card or other form of payment in person at a store. The digital transformation that continues to happen across almost every sector is changing that.

“With cards not present this type of shopping environment, the bigger the risk of disputes happening,” she said, citing a 30 per cent increase in global disputes across Visa’s network between 2019 and 2023.

Unfortunately, disputing credit card charges is highly complex and often involves a lot of manual work on the part of not only Visa but the teams within bank contact centers.

Visa is hoping to address through what was described as a first-of-its-kind partnership with ServiceNow whereby the tech firm has natively integrated Visa’s disputes questionnaire into its customer service management (CSM) product as well as chargeback eligibility rules that can streamline workflows in the middle and back office processes associated with disputes.

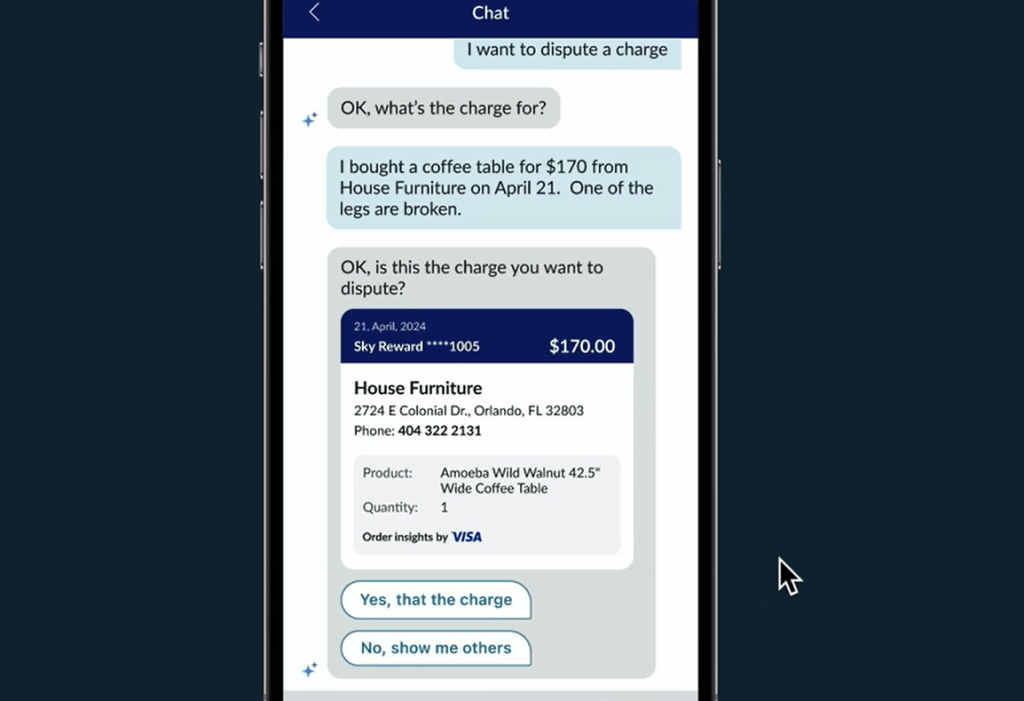

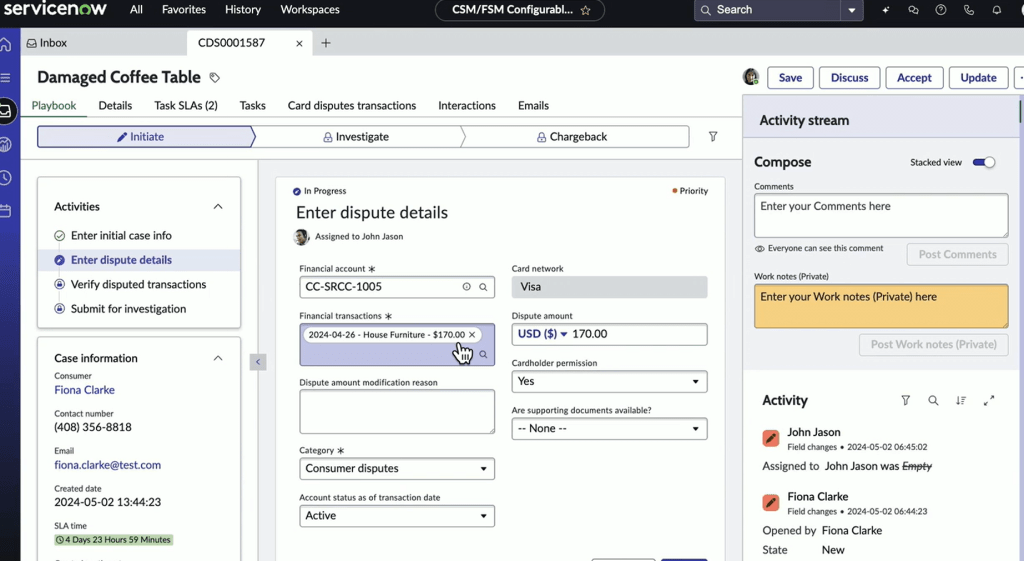

In a demo of the combined solution, ServiceNow used a fictitious customer named Fiona who was reviewing her credit card charges through a bank’s mobile app. Clicking on a questionable charge didn’t reveal a lot of information other than a merchant’s name and address. ServiceNow showed how it could pull in more details to enrich the experience by integrating with a Visa application called Order Insights Digital that showed the original receipt related to the transaction.

ServiceNow said some financial institutions have been able to deflect dispute calls by up to 30 per cent by adding this to their dispute intake process. That’s important because ServiceNow also said it costs an average of $25 to process each dispute – which can become an annual cost of $30 million.

If Fiona wanted to go through with her dispute, the integration would provide her with questions to answer — such as whether she approved the transaction, whether the product was damaged and so on – as well as the ability to upload supporting documents and files such as images of a product before submitting her claim. ServiceNow is also offering the ability to use generative artificial intelligence to manage the same process through a virtual agent or chatbot.

Within an agent workspace, meanwhile, ServiceNow and Visa’s partnership will allow contact center staff to view multiple transactions that might be associated with a single dispute, verify whether the customer submitted the right supporting documents and choose the right additional questions among hundreds that could possible be asked.

Generative AI will play a role here too in summarizing information about the many tasks that are shared across banks, credit card firms like Visa and other stakeholders. This includes when information changed hands between one party and another as part of the dispute resolution process.

Vidya Balakrishnan, ServiceNow’s vice-president and general manager of financial services, said the Visa partnership reflects the priority among financial institutions to improve the digital customer experience they deliver.

“Challenger banks and Neo banks have really been pushing our limits in terms of what customers are expecting out of their financial institutions,” she said. “Tech is truly shaping banking trends, not the other way around.”

ServiceNow’s Knowledge 2024 sessions are available on-demand virtually with registration.

Shane Schick tells stories that help people innovate, and to manage the change innovation brings. He is the former Editor-in-Chief of Marketing magazine and has also been Vice-President, Content & Community (Editor-in-Chief), at IT World Canada, a technology columnist with the Globe and Mail and Yahoo Canada and is the founding editor of ITBusiness.ca. Shane has been recognized for journalistic excellence by the Canadian Advanced Technology Alliance and the Canadian Online Publishing Awards.